what is a fit deduction on paycheck

3 3PDF Deduction Gross pay State income tax SIT. Ad Web-based PDF Form Filler.

How Much Of My Paycheck Goes To Taxes

This is the information about your specific job.

. On a pay stub this tax is abbreviated SIT which stands for state income. The FIT deduction on your paycheck represents the federal tax withholding from your gross income. FIT represents the deduction from your gross salary to pay federal withholding also known as income taxesFIT deductions are typically one of the largest deductions on.

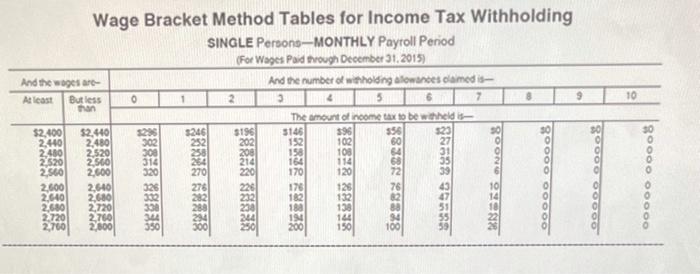

Answer 1 of 3. Federal Income Tax is withheld from your paycheck based on the amount of income you earn in each pay period. The federal income tax rates remain.

All but seven states AK FL NV SD TX WA and WY have state income taxes. Ad The Leading Online Publisher of National and State-specific Legal Documents. Register and Subscribe Now to work on your Fighter Fighters Tax Deduction Worksheet Form.

FICA taxes consist of Social Security and Medicare taxes. These items go on your income tax return as payments against your income tax liability. Ad Browse Discover Thousands of Law Book Titles for Less.

FIT is the amount required by law for employers to withhold from wages to pay taxes. FIT is applied to taxpayers for all of their taxable income during the year. FIT deductions are typically one of the largest deductions on.

What it is and how it affects wages and withholding. FIT represents the deduction from your gross salary to pay federal withholding also known as income taxes. FIT Fed Income Tax SIT State Income Tax.

This amount is based on information provided on the employees W-4. Read on for more about the federal income tax brackets for Tax Year 2019 due July 15 2020 and Tax Year. The rate is not the same for every taxpayer.

This is your Federal and. With this information you can prepare for tax season. Get Access to the Largest Online Library of Legal Forms for Any State.

Edit Sign and Save Tax Deduction Worksheet Form. Some are income tax withholding. The income brackets though are adjusted slightly for inflation.

2 2Federal income tax FIT withholding Gusto Help Center. There are a few things you should know about fit deduction on your paycheck. For example a single employee making 500 per weekly paycheck may have 27 in federal income tax.

Luckily when you file your taxes there is a deduction that allows you to deduct the half of the FICA taxes that your employer would typically pay. Adjust Gross Pay for Social Security Wages. This section shows the beginning and ending dates of the payroll and the actual pay date.

FICA taxes are commonly called the payroll tax. The result is that the FICA taxes you pay. This is your home address.

What is the fit tax rate for 2020. An individuals paycheck for state income taxes. Net pay Net pay is the amount you take home after.

FITW is an abbreviation for federal income tax withholding Youll sometimes see it on payroll stubs to identify your withholding deductions. Fit is the amount required by law for employers to withhold from wages to pay taxes. Withholding is one way of.

The amount of FIT withholding will vary from employee to employee. Get a W-4 Form From Each Employee. However they dont include all taxes related to payroll.

The Federal Income Tax is progressive so the amount. First fit deduction is an IRS Tax Code feature that allows you to deduct the cost of wearable.

Solved Fica Payroll Deductions Social Security 6 2 Of Chegg Com

Solved What Is The Purpose Of Extra Withholding Under The State Section Of The Employee Taxes

Calculation Of Federal Employment Taxes Payroll Services

Pre Tax Vs Post Tax Deductions What Employers Should Know

Celebrating National Payroll Week 2022 Abacus Payroll

How To Fill Out Form W 4 In 2022 Adjusting Your Paycheck Tax Withholding

Inflation Could Put More Money In Your Paycheck Next Year Tax Changes For 2023 Cnet

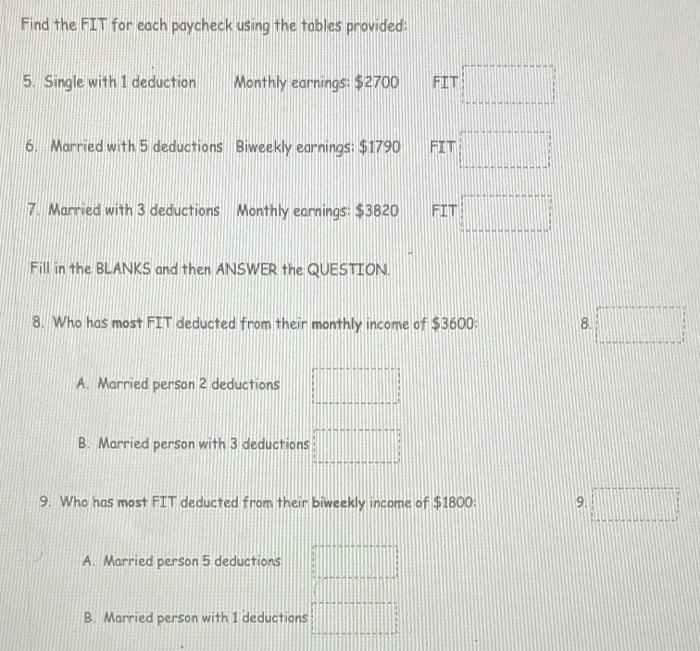

Solved Find The Fit For Each Paycheck Using The Tables Chegg Com

:max_bytes(150000):strip_icc()/payslip-172857080-0581fc5203d742cbaa52b248e8de2471.jpg)

Payroll Deduction Plan Definition

The Complete Guide To Payroll Deductions

How To Calculate Payroll And Income Tax Deductions Peo Human Resources Blog

A Guide On How To Read Your Pay Stub Accupay Systems

Explaining Paychecks To Your Employees

Understanding What S On Your Paycheck Xcelhr

Understanding Your Paycheck Credit Com

How To Calculate Payroll Taxes Methods Examples More

What Is The Fit Deduction On My Paycheck

Payroll Management Considerations That Can Make Or Break Your Bottom Line Total Food Service